01 Feb Latest Income Tax Slab for FY 2025-26: Budget 2025 Highlights

In the Union Budget 2025, Finance Minister Nirmala Sitharaman introduced significant changes to the income tax slabs under the New Tax Regime, offering major benefits to the salaried taxpayers and the middle class. The key change is that individuals earning up to Rs 12 lakh will not have to pay any income tax. This move recognizes the contribution of India’s middle class to the economy and aims to provide them with more disposable income.

Key Announcement in the Budget 2025

FM Nirmala Sitharaman stated that the government has consistently worked to reduce the tax burden on the middle class. Since 2014, the tax-free income threshold has increased progressively:

- Initially, it was Rs 2.5 lakh.

- In 2019, it increased to Rs 5 lakh.

- In 2023, it was raised to Rs 7 lakh.

- Now, in 2025, people earning up to Rs 12 lakh will be exempt from income tax.

This change is part of a broader effort to enhance the economic situation of the middle class, which plays a crucial role in India’s growth.

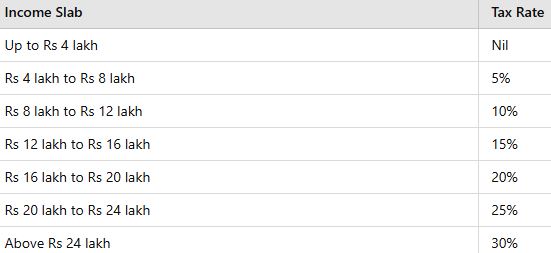

New Income Tax Slabs for FY 2025-26 (Under the New Tax Regime)

Effective from Assessment Year 2026-27, the following income tax rates will apply under the New Tax Regime for individuals:

Tax Exemption for Salaried Individuals

For salaried individuals, the tax exemption is even more beneficial. Since the standard deduction of Rs 75,000 applies, the income tax exemption threshold for salaried individuals increases to Rs 12.75 lakh. This means that individuals earning up to Rs 12 lakh will not pay any tax, after considering the standard deduction.

Middle Class Benefits and Impact

FM Sitharaman emphasized the role of the middle class in the nation’s economic progress. With the new tax slabs, the government is giving more money back to the people. The changes will help:

- Increase disposable income.

- Encourage more spending, saving, and investing by the public.

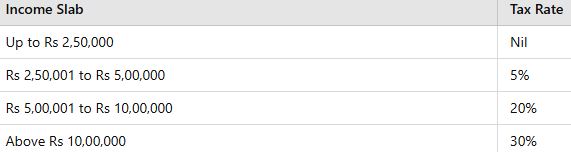

Old Tax Regime Slabs for FY 2025-26

The Old Tax Regime has not seen any changes and continues to have the same tax slabs:

In this regime, taxpayers can still avail of various exemptions and deductions such as Section 80C and HRA.

How Much Income Do You Save After Budget 2025?

The changes in the income tax slabs will have a significant impact on the tax payable by individuals. Here are a few examples to show how much you can save:

For an income of Rs 12 lakh:

- Tax benefit of Rs 80,000.

- Complete tax exemption (after applying the new tax slab and standard deduction).

For an income of Rs 18 lakh:

- Tax reduction of Rs 70,000.

- The tax rate drops to 30% of the previous tax liability.For an income of Rs 25 lakh:

- Tax saving of Rs 1,10,000.

- The new tax regime reduces the tax by 25% compared to previous years.

Conclusion

The Budget 2025 brings major relief to the middle class and salaried individuals with higher tax exemptions and lower tax rates under the New Tax Regime. This will help them save more and have more disposable income for spending, savings, and investments. Whether you choose the New Regime or the Old Regime, the changes in the income tax slabs are aimed at reducing the tax burden and supporting the growth of the economy.